- Key Compliance Strategies For RIAs Post-Acquisition

- Finding The Right RIA Compliance Partner: Ditch The “One-Size-Fits-All” Approach

- AdvisorLaw’s Criminal Expungement Week for Financial Advisors

- 2017 Termination Disclosure Wiped From Texas Advisor & CCO’s Records

- 10 Questions Wirehouse Advisors Should Ask Themselves Right Now

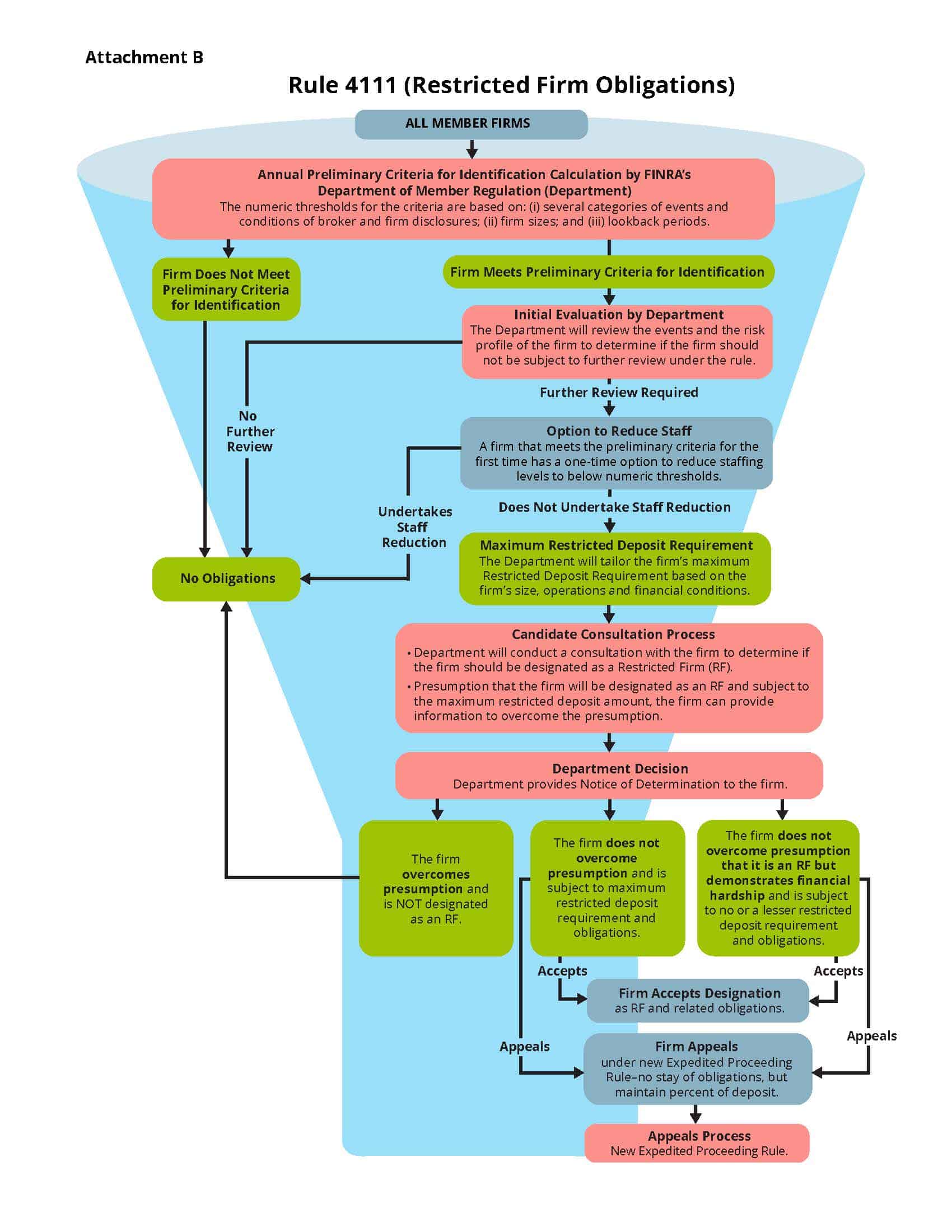

As of June 1st, the new FINRA Rule 4111 is now effective, and the SRO has been hard at work attempting to highlight and hold accountable firms that house an excess of brokers with negative disclosures. Through metrics focusing on negative BrokerCheck disclosures, such as customer complaints, terminations, and brokers who were previously employed at expelled firms, FINRA believes it has found the silver bullet for rooting out rogue brokers — make the firms do FINRA’s dirty work.

As of July 11th, firms now have access to FINRA’s “Preliminary Criteria for Identification” report.

These initial metrics focus on how many brokers are employed at the firm with a history of misconduct. If a firm surpasses FINRA’s acceptable threshold, that firm could earn a “restricted” status if action is not taken immediately.

Under Rule 4111, firms essentially have two options:

1.) Terminate brokers with disclosures. Reducing the firm’s overall disclosure count effectively takes the firm out of the crosshairs and gently nudges FINRA’s sights set on the next-highest offending firm — in the vein of the time-honored saying that you don’t have to run faster than the bear, just run faster than the guy next to you.

2.) Give FINRA a ton of money. Rule 4111 gives firms a secondary option (one you can be sure the firm won’t choose) of depositing some of the firm’s capital in a restricted deposit account, in an amount not less than the member firm’s restricted deposit requirement.

Faced with two equally-bitter pills, we have seen many of firms’ top brass reach out to AdvisorLaw to obtain a third option — one that allows them to both jump the line from that chasing bear and keep their full stable of brokers.

Enter AdvisorLaw’s Enterprise Expungement program

CEOs and CCOs are teaming up with AdvisorLaw to address this problem head-on, by coordinating efforts to open expungement cases for their most exposed reps. AdvisorLaw is putting in the time to conduct preliminary viability testing into each rep’s disclosures and provide firm leadership with a game plan to remove the lion’s share of contributing disclosures.

With 55 employees and nearly 20 attorneys, AdvisorLaw can represent these cases concurrently, while being able to afford the firms with unique, Enterprise-level benefits and guarantees that are simply not available elsewhere.

Proposed restrictions to the Expungement process

FINRA plans to revamp and reorganize its present expungement procedure, possibly eliminating customer dispute arbitrations entirely and relying on FINRA and state securities regulators to determine whether disclosures can be purged. Many questions concerning how that procedure might be conceived and implemented are highlighted in their discussion paper.

The SEC’s approval, as well as possible congressional action, will be required to put that mechanism into place. Whatever the changes may be, FINRA’s goal is clear: administrative control over expungement. Their objective is not to ensure the merit of the claims in the CRD system and on BrokerCheck. Rather, FINRA is seeking to reduce the number of expungement claims sought by advisors altogether.

We can help you remove your negative disclosures

AdvisorLaw has been successful in obtaining the removal of decades-old disclosures. If you have disclosures on your record, there will never be a time in the future where your chances at winning expungement are better – they will only get worse.

Contact us today. We can help you think outside of the box to chart the fastest route through that forest and save you from the bear.