Have you ever heard of Rule 4111? Unless you’re an officer at your firm, it’s unlikely that you have. As AdvisorLaw exclusively represents individual financial advisors, we typically have little reason to comment on a proposed FINRA rule that will apply to broker-dealers. However, when that rule is going to significantly affect small firms’ decisions of whether to retain certain financial representatives, it’s time to educate and inform.

Background On The Rule 4111 Proposal

FINRA initially proposed Rule 4111 on July 1, 2019, and the last amendment to the proposal was approved, on March 4, 2021. FINRA is set to start evaluating its members on June 1, 2022, while the actual Rule will take effect starting July 1, 2022.

Rule 4111 began as a way to impose additional capital requirements on firms with a significant history of misconduct. The Rule’s maximum “Restricted Deposit Requirement” (RDR) acts as an additional insurance policy, or a sort of regulatory hammer, to use against small firms, where problematic advisors tend to congregate and hang their licenses.

These firms, identified as “restricted firms,” will have to maintain a financial deposit (in the form of cash or securities) in a segregated account, at a bank or clearing firm. The amount of the deposit is to be determined at the sole discretion of FINRA, and the firm’s ability to withdraw will be restricted, subject only to FINRA approval.

While it does not appear that FINRA will provide firms with a tool for determining what the deposit amount will be, FINRA ensures us that the amount will need to be sufficient to cover all pending arbitration claims and unpaid arbitration awards for the firm and its associated persons, and the amount will be tailored, based upon the size, operations, and financial conditions of the firm, itself.

To attempt a guess: it will be a big number.

Reading further between the lines, we find that FINRA made sure to set a maximum for the deposit amount:

“…the Department would determine a maximum Restricted Deposit Requirement for the member firm that would…not significantly undermine the continued financial stability and operational capability of the member firm as an ongoing enterprise over the next 12 months.”

In other words, FINRA capped the deposit at an amount that would not cause the firm to be insolvent within the year.

Which Firms May Be Subject To This?

The next question is likely: will my firm be targeted?

The actual text of the Rule spends pages upon pages identifying the multi-step process—read the entirety of the proposed Rule here, if you’re a masochist. It’s not exactly a beach read. So let us distill the important parts.

The regulator sets up six categories of calculations that begin by adding the total firm and rep disclosures on Forms BD, U4, U5, and U6. Disclosures, such as customer disputes, terminations (especially from expelled firms), pending disputes, and regulatory, criminal, and civil judgments all count toward the scoring mechanism. Next, FINRA assigns weight to the various factors, based on the size of the firm. The result is a threshold number that, if exceeded, allows FINRA to “preliminarily identify” that particular firm as one that should be restricted.

FINRA seems to indicate that all firms will be subject to this new rule, but that is nothing more than a smokescreen of fairness. Based upon hypothetical test runs by FINRA itself, it was found that:

– FINRA will investigate up to 80 firms, or about 2% of the industry, per year.

– Of those, small-sized firms (<150 reps) constitute about 91%,

– mid-sized firms (151-500 reps) constitute about 8%.

This is not a large firm problem—it is squarely aimed at the small firm that has less than 150 reps.

So far, FINRA has not disseminated a simplified calculator of disclosures for a firm to determine whether it will make the “naughty list.” And, given the myriad variables at play, it is likely that your internal compliance will have little foresight on the issue. We expect that the vast majority of firms that receive notice from FINRA will end up operating in a purely-reactionary fashion.

Why Should Financial Advisors Care?

Once your firm is identified as a possible restricted firm, it must take action to rectify the situation, via FINRA Rule 4111. This is the inflection point at which a rule aimed at broker-dealers starts to transfer risk to financial advisors.

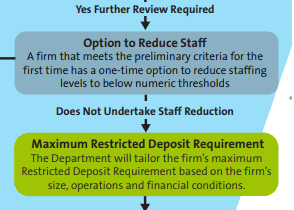

Take a look at this direct snippet of the flow chart that FINRA provided in the Rule 4111 proposal (Attachment B). This includes every possible remedy available, once the Department identifies the BD as a possible restricted firm.

Yes, that’s it. At this point, your firm will be facing a binary option. The broker-dealer must either: (A) accept the maximum Restricted Deposit Requirement; or (B) conduct a mass layoff of advisors with disclosures, in order to fall beneath the numeric thresholds.

Again, let us look closely at the fine print: FINRA affords the firm a “one-time option” for layoffs—one, single event. Everyone who needs to go must go. If the firm lays off some of its financial reps and does not achieve a sufficient reduction per FINRA’s algorithm, the firm will still have to institute the RDR.

So here’s where it gets really interesting.

Call us cynical, but over the last several years of defending thousands of financial advisors, we have seen our fair share of meritless terminations. It is fair to say that, in the vast majority of U5 terminations, firms have attempted to “weaponize” the U5 disclosure. In an industry where a U5 disclosure is a virtual scarlet letter, it has become commonplace for a firm to fire a rep, mark up their U5 with a public disclosure on BrokerCheck, and proceed to call the advisor’s clients and warn them of serious wrongdoing, in an attempt to keep the investor and jettison the commissionable rep.

What’s the worst part for advisors? The firms have a free pass from FINRA to terminate you!

It will be awfully difficult for an advisor to claim wrongful termination when FINRA essentially forces the firm to terminate. An action that could otherwise be seen as weaponized now becomes a thoughtful, pragmatic, and necessary decision for the greater good.

Under FINRA’s new Rule 4111, it should be obvious that any financial advisor with several disclosures who is registered with a small firm should keep their head on a swivel. Unless you are an officer at your firm, you are likely not privy to whether your company is being “preliminarily investigated” by FINRA. And you can certainly imagine that a firm in the crosshairs will endeavor to hold any type of regulatory investigation close to the vest. After all, they don’t want to worry or sow the seeds of doubt among the troops.

Are your firm’s executives having a roundtable discussion as to which of the two available routes they should take? If you were an officer responsible for the financial well-being of your firm, which option would you choose: giving FINRA a bunch of extra money that can never be touched, or identifying as many reps with the most disclosures as possible, terminating them, and retaining as many clients as you can?

If you want to mitigate your exposure, contact us here. We have cleaned up more disclosures for advisors over the last five years than the rest of the industry combined.

AdvisorLaw’s services were created exclusively for financial advisors and wealth managers. Contact us to learn more about our Disclosure Expungement services.