- Key Compliance Strategies For RIAs Post-Acquisition

- Finding The Right RIA Compliance Partner: Ditch The “One-Size-Fits-All” Approach

- AdvisorLaw’s Criminal Expungement Week for Financial Advisors

- 2017 Termination Disclosure Wiped From Texas Advisor & CCO’s Records

- 10 Questions Wirehouse Advisors Should Ask Themselves Right Now

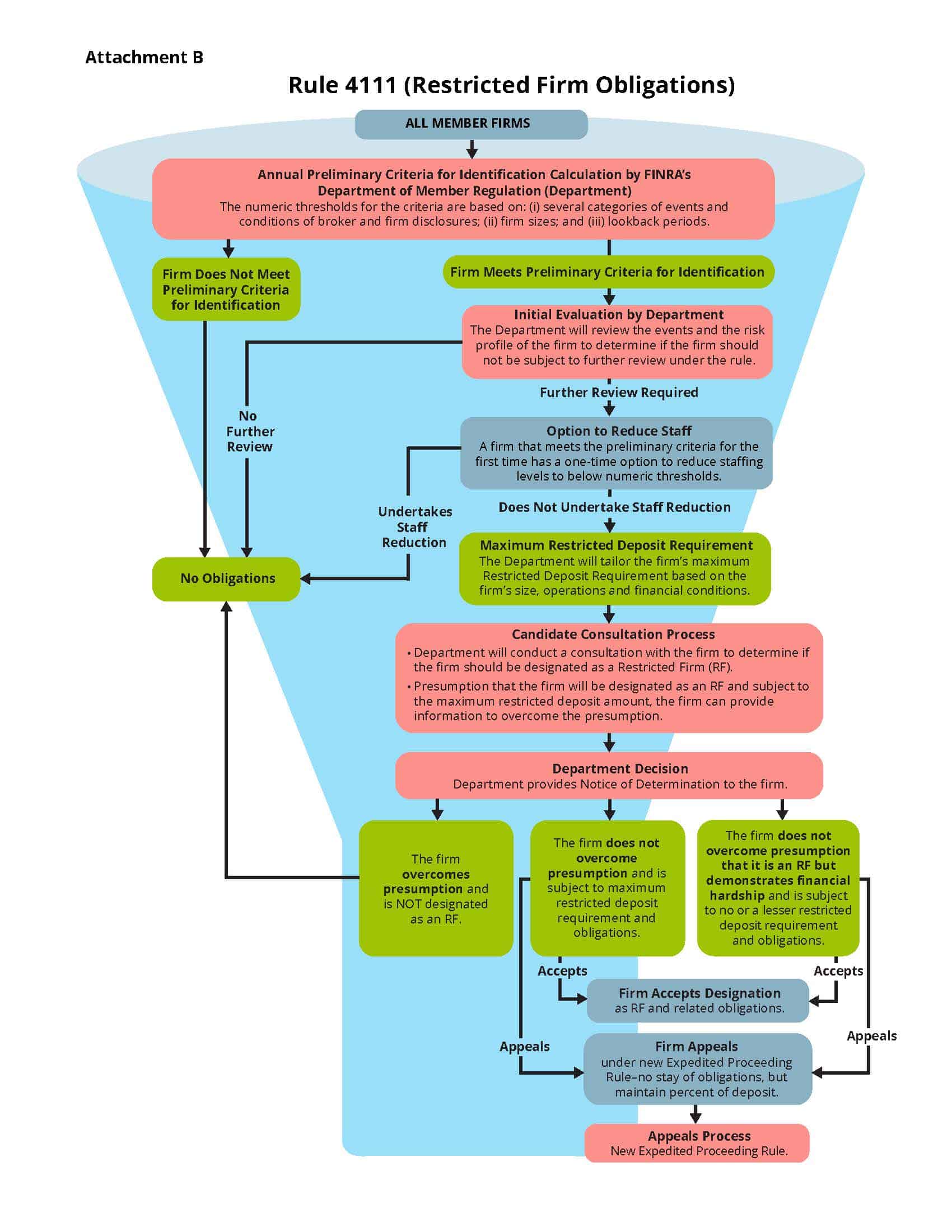

Evaluations Under FINRA Rule 4111

FINRA-member firms and brokers across the U.S. have been under immense pressure over the last month since FINRA began its firm evaluations under the new FINRA Rule 4111. Broker-dealers are now essentially given two choices: either (1) keep advisors with BrokerCheck disclosures, and in turn become “restricted” and hit with a long list of limiting requirements and harsh sanctions; or (2) terminate any reps with multiple disclosures — immediately. Evaluations ended on July 11th, and FINRA will now begin informing firms of their designations.

Rule 4111 Overview

FINRA approved Rule 4111 on September 28, 2021. The rule grants the regulator the authority to impose new constraints on broker-dealers that have higher numbers of what it terms “risk-related disclosures.”

Based on the specific criteria set forth in FINRA Rule 4111, the self-regulatory body is now granting itself free reign to determine whether a firm should be considered a danger to investors and labeled as restricted. Once designated as restricted, a firm will have six months to make the changes required to free itself from the accompanying obligations. The firm will then have the option to either accept the designation or challenge it through an appeal.

Each firm that accepts the label must set up reserve cash or securities in a separate, “restricted deposit account.” The funds held in restricted deposit accounts are to be used for litigation, should the company close, as well as for to be used toward both currently unpaid and potential, future investor claims and customer settlements. The amounts held in the accounts must be enough to satisfy all outstanding arbitration awards for the firm and its related individuals — despite the fact that it doesn’t seem as though FINRA will be providing any calculator for determining those amounts. The exact deposit amounts will vary, depending on the size, financial health, and operations of each firm. The amount of money that firms can remove from the accounts will be limited, and as the funds and securities in restricted deposit accounts can only be utilized with FINRA’s permission, FINRA clearance is required for any withdrawals from the accounts. Simply put — the required deposits will be sizable.

From what we can tell, being classified as restricted will be a death blow for many smaller firms, and it will cost FINRA and the financial services sector a sizable number of its representatives.

On June 1st, FINRA began its firm evaluations and started providing many firms with a preliminary report, informing them of whether they would be included on the new restricted-firm watchlist. In anticipation of the implementation of the rule and FINRA evaluations, many broker-dealers started firing brokers with BrokerCheck disclosures, en masse, and there’s reason to believe that more and more firms will continue to do the same.

Not surprisingly, FINRA has been encouraging firms to terminate any “troublesome” reps during its evaluation period. Kosha Dalal, vice president and associate general counsel in FINRA’s Legal Policy Division, suggests that broker-dealers be “proactive,” by terminating reps who fall into higher-risk categories. FINRA’s pressure places firm officers in the position of having to choose whether to give a sizable sum of money to FINRA, which the firm cannot access, or find the most reps with the most disclosures, fire them, and keep as many of their clients as possible. In this manner, the risk shifts from the broker-dealer to the financial advisor.

Small-firm advisors with several disclosures should be cautious. Unless you’re a corporate officer, you’re unlikely to know whether your firm is being preliminarily probed by FINRA, and it’s understandable that a company in the crosshairs would try to keep any regulatory probe close to the vest — no one wants to spark concern or foster doubt among their employees.

Over the last six years, AdvisorLaw has succeeded in expunging more disclosures for advisors than the rest of the industry, combined. If you have multiple disclosures on your record, or you need assistance amending the language on a recent Form U5 amendment, AdvisorLaw can help. Our team of experts can also help you navigate any FINRA investigations that may ensue.

Or if you’re ready to trade in your FINRA membership to join the ranks of thousands of independent RIAs regulated by the SEC, our attorneys can provide counsel to guide you through the transition, set up your new RIA business, and provide both initial and ongoing compliance services.

FINRA’s Discussion Paper On Expungement

We’ve been paying close attention to recent developments concerning upcoming restrictions to FINRA’s expungement process. In a discussion paper released in May 2022, FINRA proposed a host of new changes to the procedure, including:

- creating a roster of arbitrators with specialized training;

- requiring a three-member panel;

- prohibiting strikes and stipulations to remove an arbitrator;

- setting time limits to prevent expungement after more than six years from the complaint or more than two years from the close of a customer arbitration;

- providing notice to state regulators upon the filing of an expungement request; and

- when an arbitration has been filed, requiring financial advisors to seek expungement from the same panel that heard the arbitration.

There have also been talks of strengthening the requirements of FINRA’s Rule 2080 — the criteria by which expungements may be granted. Additionally, there has been discussion of altering the disclosure obligations of firms and advisors, which will most certainly broaden the types of events and number of disclosures required to be reported.

The idea of ultimately leaving expungement decisions up to state regulators is unsettling because it exposes advisors to yet another round of opposition while decreasing the likelihood that expungement will be granted.

Without the option to choose arbitrators, advisors end up essentially playing Russian roulette with their odds of getting customer dispute claims dismissed — regardless of how ridiculous or unjustified the accusations may be.

However you look at it, it’s obvious that FINRA and groups like PIABA will not back down, and their attempts to make expungements more and more difficult for advisors to obtain will continue. If you have disclosures on your record, your prospects of obtaining expungement will never be greater — your opportunity to seek expungement could be tremendously diminished in the near future. Reach out to AdvisorLaw today if you’re even considering seeking the removal of a negative disclosure from your record.

Regulating “Complex Products”

On May 9th, the comment period for FINRA’s Regulatory Notice 22-08 — which aims to address concerns about the ease with which retail customers may trade complicated products — officially closed. FINRA claims to have received thousands of comments, many of which were from concerned advisors and member firms upset by increased regulatory overreach, as well as from pushy investor-protection groups that continue to bully FINRA into further restricting current measures.

The Securities Industry and Financial Markets Association (SIFMA) sent a long letter to FINRA highlighting several issues that it found with the new guidelines on complex products. One critic asked for a better and more specific definition of the term “complex products,” which it asserts is now “too ambiguous and overinclusive.”

Last month, at FINRA’s Annual Conference, FINRA CEO, Robert Cook, and SEC Chair, Gary Gensler, shared their views on the new rules regarding complex products. Gensler agreed that a compromise must be reached between the risks that investors are willing to accept and the obligations of broker-dealers to recommend risk-appropriate investments.

Once FINRA has completed analyzing all of the comments, it will determine whether any additional action is necessary and what that would entail.

Defending Yourself

AdvisorLaw has been serving representatives in the financial industry for nearly 10 years. We’ve seen it all — the good, the bad, and the downright ugly — and our passion for defending financial advisors and wealth managers has never been stronger. As we continue to protect advisors and RIAs from damaging termination disclosures, meritless customer disputes, and false regulatory violation disclosures, we always seem to get back to asking ourselves the same question: who’s here to protect advisors?

If you find yourself under FINRA or SEC investigation, your best chance of making it out unscathed is to have expert counsel to guide you through the process. We’ve handled more than 2,000 cases across the U.S. and helped thousands of advisors fight for their right to be heard.

If you’re under investigation, or you’re dealing with a meritless disclosure on your record, contact AdvisorLaw today.

For a complimentary consultation, please fill out the form below: