D.C. Financial Advisor Removes Sole Termination Disclosure

Over a decade into his career, a D.C.-based investment advisor rep had a five-year-old termination disclosure for allegedly failing to comply with firm policies regarding outside business activities (OBAs). Seeking...

Read More

Can I be terminated due to an investor complaint?

In this week’s Ask An AdvisorLaw Expert, we’re asking the OG of FINRA industry disputes, Dochtor Kennedy, MBA, J.D., what happens when investors make formal complaints against advisors and how...

Read More

Florida Advisor Scores Epic Win With Removal Of 9 Disclosures

Between 1999 and 2021, this 30-plus-year industry veteran accumulated nine customer disputes on his public records, four of which reflected settlements that ranged from $15,000 to nearly $200,000. With FINRA’s...

Read More

SEC Penalties Prompt RIAs To Employ Greater Compliance Oversight

Over the last year, the SEC rolled out new rules and regulations regarding Form 13F, Form ADV, private funds, marketing and advertising, and environmental, social, and governance disclosures. Now, regulators...

Read More

Ask an AdvisorLaw Expert: Can I form an RIA prior to leaving my current firm?

There are a number of important factors that an advisor needs to consider when deciding to leave a firm to form their own RIA. On this week’s Ask An AdvisorLaw...

Read More

Financial Advisors: The Time to Plan For Retirement is Now

Contact Us Today! In a new guidance document, the Financial Industry Regulatory Authority (FINRA) sent a stark warning, urging member firms and representatives to form their succession plans as soon...

Read More

Boca Raton Financial Advisor Clears Records With Expungement

More than 30 years into his career in the industry, this Boca Raton-based advisor had two customer disputes that had plagued his records since the 1990s. Seeking to once again...

Read More

Will Your RIA Avoid Our Biggest 2022 SEC Deficiencies?

AdvisorLaw’s RIA services division has compiled a list of the most common SEC exam deficiencies we saw in 2022. The deficiencies below were found amid compliance documentation from RIA firms...

Read More

Florida Advisor Restores Perfect BrokerCheck Record

A 20-year industry veteran in Florida had a spotless public BrokerCheck record — until he was slapped with a customer dispute disclosure in 2019. The dispute alleged a breach of...

Read More

When should I start planning to sell my advisory practice or RIA?

When you’re looking to sell your advisory firm or RIA, there are many factors at play that could impact how seamless and profitable the transaction will be. This week on “Ask...

Read More

FINRA Disputes & U5 Terminations FINRA Expungement & Arbitration FINRA, SEC, State & CFP Board Enforcement

The Importance Of Keeping Your FINRA Form U4 Disclosures Up-To-Date

Being an investment advisor comes with a lot of responsibility. Not only do you have to keep up with the latest market trends and changes, but you also need to...

Read More

Illinois Advisor Erases 2001 Misdemeanor Criminal Disclosure

An Illinois advisor spent his first 15 years in the industry with a criminal disclosure on his record that had resulted from an incident that occurred while he was in...

Read More

Navigating An Audit From The SEC

More Registered Investment Advisor (RIA) firms are being audited than ever before. Earlier this year, the U.S. Securities and Exchange Commission (SEC) released a report from the Inspector General's Office...

Read More

Arbitration Panel Rewards Expungement of 2 Disputes From 2003

A New Jersey Advisor approaching 35 years in the industry had two customer disputes that had plagued his records for nearly two decades. He decided to take the opportunity to...

Read More

Florida Advisor Removes Termination Disclosures From Records

An advisor in Florida had a termination disclosure on his CRD, IARD, BrokerCheck, and IAPD profiles, as well as an accompanying internal review disclosure on his CRD and IARD records....

Read More

FINRA Disputes & U5 Terminations FINRA Expungement & Arbitration FINRA, SEC, State & CFP Board Enforcement

Do BrokerCheck disclosures ever fall off automatically?

Having a clean public record in the financial services industry is crucial. This week we’re talking with Harris Freedman, J.D. to discuss the types of disclosures that will naturally fall...

Read More

Weaponized Form U5

Any time a rep exists at a firm, whether the reason involves an involuntary discharge, a voluntary resignation, or a rep being permitted to resign, firms and broker-dealers are required...

Read More

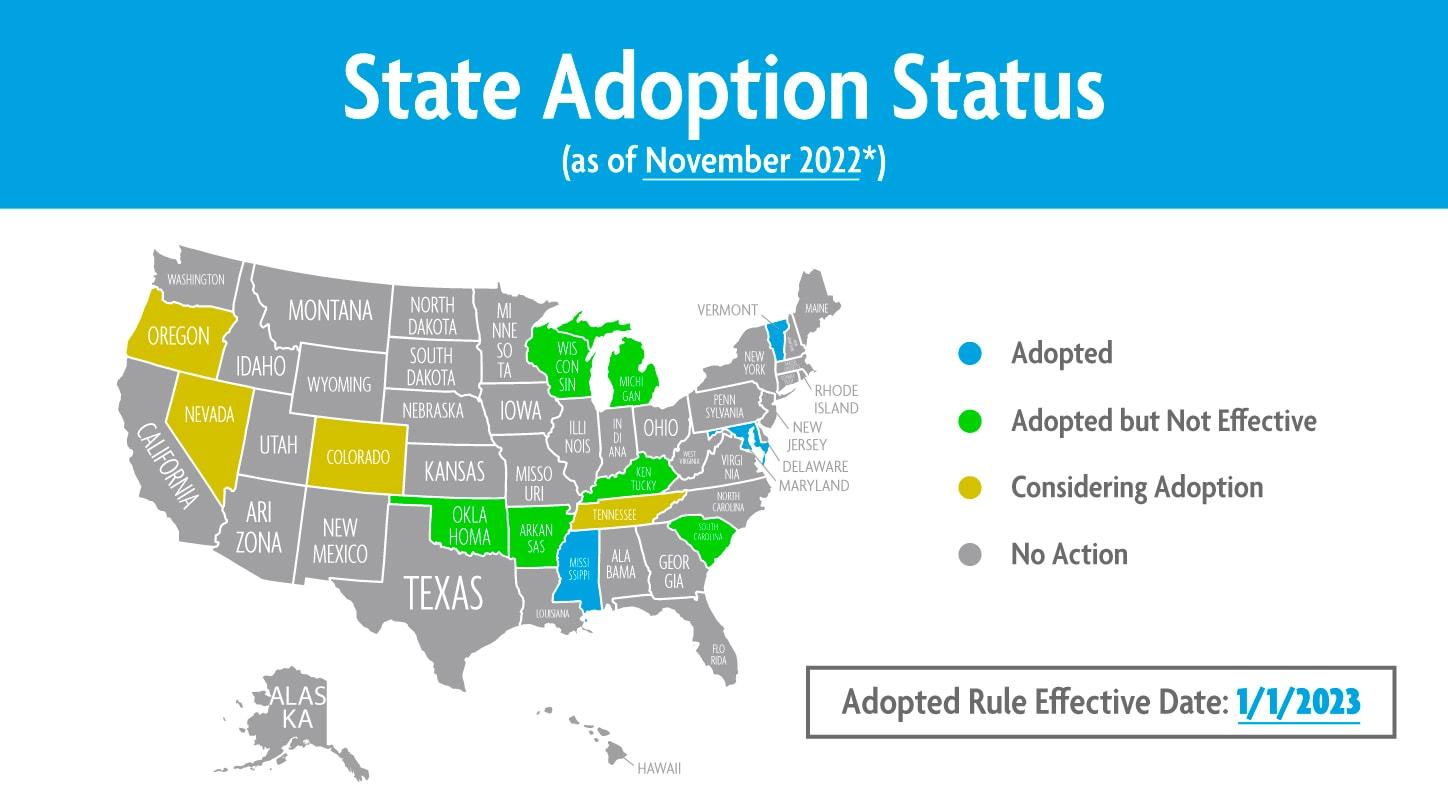

IARs Required to Complete Continuing Education Program

At AdvisorLaw, we do our best to keep our clients informed of regulatory changes. Launching our continuing education (CE) offerings is an example of our commitment to helping you stay...

Read More

FINRA’s Expungement Reform Takes a Turn for the Worse

In August, AdvisorLaw made a public comment concerning FINRA's latest effort to undermine the expungement procedure. We found that FINRA’s proposed rule change not only denies fundamental rights to financial...

Read More

Memphis Advisor Clears Disclosures From BrokerCheck and CRD

A Tennessee advisor who began his career in 2000 had acquired three customer disputes between 2005 and 2016. The first was closed with no action, and the second was denied....

Read More