- Key Compliance Strategies For RIAs Post-Acquisition

- Finding The Right RIA Compliance Partner: Ditch The “One-Size-Fits-All” Approach

- AdvisorLaw’s Criminal Expungement Week for Financial Advisors

- 2017 Termination Disclosure Wiped From Texas Advisor & CCO’s Records

- 10 Questions Wirehouse Advisors Should Ask Themselves Right Now

In June 2016, AdvisorLaw saw a glaring opportunity in the financial sector. Although the industry was rife with intelligent, hardworking, and well-intentioned folks, there were many hurdles for those working to build a career in this hyper-regulated industry. In this field, built for (and around) money, seemingly any misstep — no matter how innocuous — begot a severe regulatory consequence. Oftentimes, the punishment of which was great enough to obliterate a career entirely.

Given that landscape, imagine our shock when we determined that there was not one single firm that championed causes in defense of individual brokers and wealth managers.

Sure there were the industry lobbyists, who purportedly stood for the rights of the entire class. We even counted a handful of attorneys who begrudgingly accepted cases defending individual financial advisors. But they were simply “hired guns,” who would defend an advisor one day and bring an action against an advisor the next — acting as mercenaries, with zero allegiance and many conflicts of interest.

And who could blame them, really? Wirehouses and regional firms had deep pockets and frequently hired outside counsel to litigate industry disputes. As we all know, biting the hand that feeds you is rarely the smart option.

However, where one firm sees risk, another sees opportunity.

AdvisorLaw was founded to fill this blind spot in the financial advice industry. We are the firm that stands as devoted counsel exclusively for regulated financial professionals. Not on any firm’s payroll, we’ve sought to distinctively entrench our firm as an invaluable partner to approximately 600,000 individuals — by safeguarding both our client’s reputations and their literal source of income.

A Tool Capable Of Harm

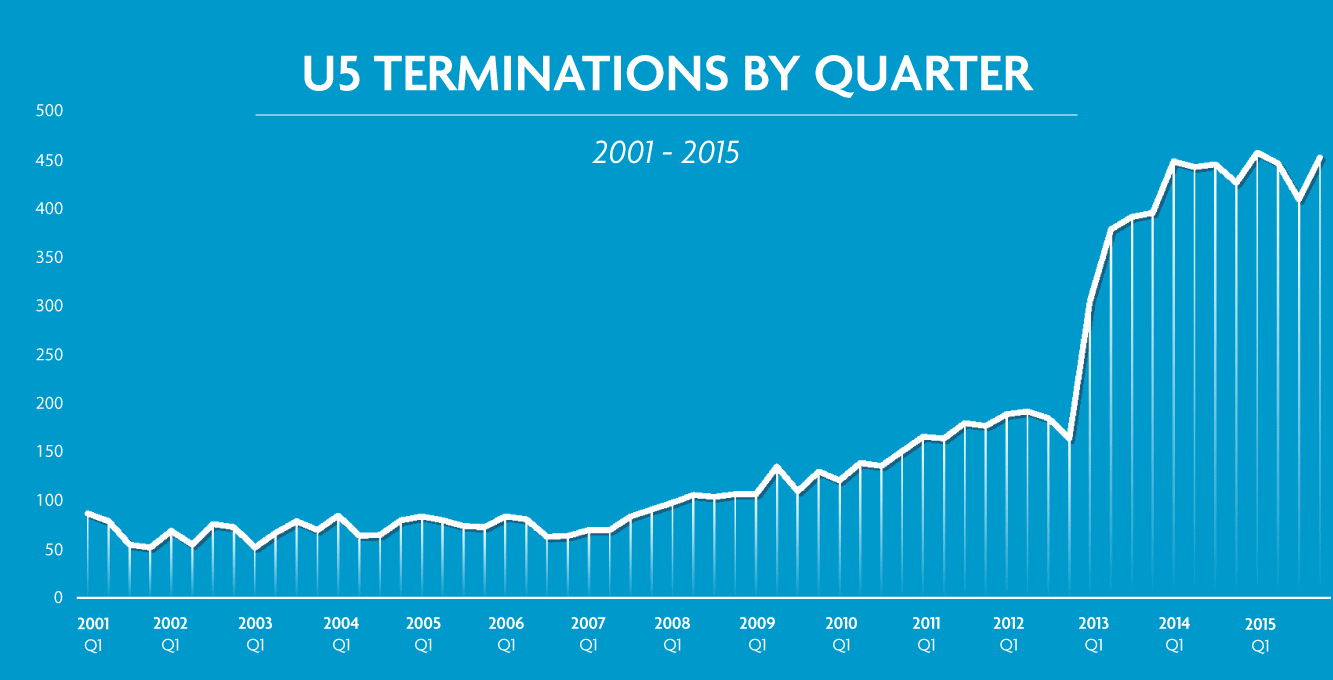

For the first decade of the 2000s, the industry operated in a manner that many would expect. A few bad apples received the boot, the employing firm marked up their BrokerCheck and IAPD record as a “buyer beware” to other firms, and the vast majority of good financial advisors operated under the radar. Indeed, until 2012, the industry only averaged around 100 terminations, per quarter.

Then in the first quarter of 2013, the total termination disclosures sharply doubled. The data suggests that this eruption was caused by a single wirehouse terminating reps as an actual business methodology. That one firm increased its U5 termination disclosures, from a total of 18 in 2012, to a total of 235 in 2013 — an increase of 1,200%.

As terminated advisors had little penchant for fighting their firm’s limitless resources, the average number of terminations would skyrocket to more than 400 per quarter, between 2013 and 2018.

AdvisorLaw Enters The Scene

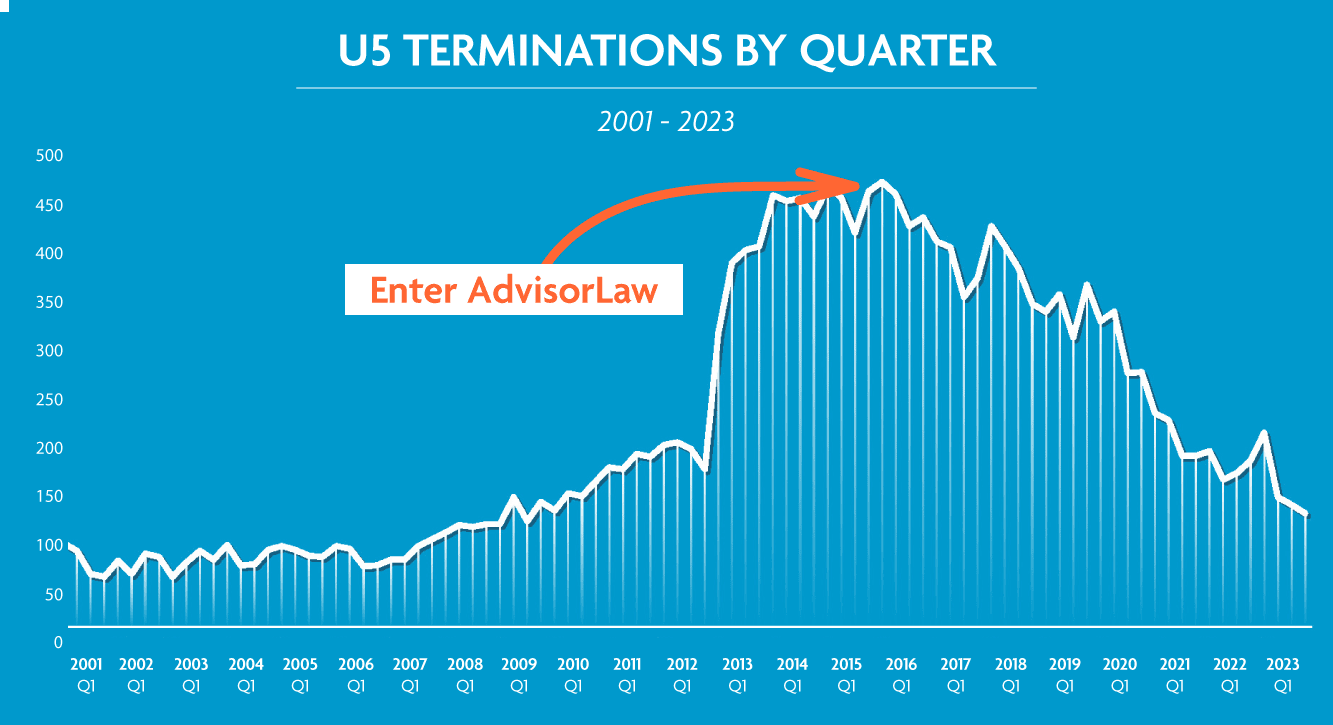

By 2016, U5 terminations would be breaking records — reaching their highest peak since the turn of the millennium. While the U5 disclosure started as a rather blunt object, over the years, it became a deadly, makeshift weapon — one that was being used by broker-dealers and RIAs to annihilate career options (and presumably keep as many investor assets as they could) of advisors who the firms now considered enemies.

Initially, in a bid to remove the sting from these disclosures, AdvisorLaw attorneys began a wave of negotiating the actual language that appears in new U5 disclosures. Most advisors were unaware that they had 30 days to argue for any amendment to the allegation verbiage. Additionally, they could also argue that the termination type be listed in such a way that kept it from being posted to BrokerCheck entirely.

If you review old termination disclosures, you will see the expansive latitude that compliance folks took in marking up advisors’ records. Because the termination often cited mere allegations, the verbiage could often be fantastical and incendiary. Even in many cases where the termination was coded as a “voluntary” resignation, the corresponding verbiage often explicitly spoke of a cryptic “investigation” — a word and an implication that carried enough weight to:

- trigger a FINRA or SEC inquiry; and

- raise a red flag to investors, suggesting that their advisor was guilty of something not yet known.

These two outcomes, within weeks of the termination, would help drain the financial resources of the terminated advisor — all while the advisor might also have been unable to simply obtain their disputed income due from the firm.

Once advisors began hiring AdvisorLaw, however, firms were immediately met with advisors who now had a competent and robust defense. By merely arguing for the interests of the advisors, we began to show these firms that advisors will not go gently into the night. Our defiance alone forced in-house counsel to, at the very least, have an accurate and defendable position for the termination reason — which had not always been the case.

The Battle’s Turning Point

In cases when the termination had happened more than 30 days prior, AdvisorLaw took an even more confrontational angle to thwart these firms. By aggressively pursuing a straight-in expungement request through FINRA’s Dispute Resolution forum, AdvisorLaw effectively created a time machine, by which we could eradicate the existence of the weaponized disclosure.

Over several hundred U5 expungement cases, we’ve found scant instances where the allegations, the verbiage used by compliance, and the termination cause were all congruent and justified against the advisor. In the absence of those criteria being met, however, the firms find themselves in a predicament. Because the firm is the publisher of the information (and not just the messenger, as it is with a customer complaint), firms must vigorously defend these expungement claims. The odds are heavily in favor of the advisors, because in the vast majority of these weaponized terminations, the language is simply inaccurate — even more likely, it’s defamatory in nature.

Again, not only does fighting back against these meritless allegations help in the specific case at hand — but the aggregate of claims filed against firms that used terminations as weapons has reset the tone. Since 2016, firm compliance has known that it better make sure that its allegations can be defended against in FINRA’s arbitration forum.

U5 Terminations On The Decline

Over the last eight years, our courageous clients, along with our attorneys’ expertise, have generated a material effect on the ability of financial firms to wield termination disclosures as a method of retaliation. While we know the number of errant disclosures will never reach zero, we are confident that our unwavering commitment to the interests of regulated financial professionals will continue to see gains.

The objective of these countermeasures is not only to immediately safeguard our clients’ careers and reputations — it’s also to allow them to be able to realize the true return of their decades of investment when they ultimately sell or transition their practices.

Form U5 Termination Week ━ March 25th – March 29th

Feeling burned by a negative U5 Termination disclosure? Don’t let an unjust U5 control your career. Join AdvisorLaw for Form U5 Termination Week from March 25th to 29th!

- Get a FREE consultation with an experienced attorney to discuss your options.

- Save $1,000 on expert guidance and U5 expungement services (if applicable).

- Take control of your future, and fight for what you deserve.

Stay tuned! In the meantime, check out our U5 termination expungement Success Stories to see how we’ve helped advisors clear their records and get back on track.