- Key Compliance Strategies For RIAs Post-Acquisition

- Finding The Right RIA Compliance Partner: Ditch The “One-Size-Fits-All” Approach

- AdvisorLaw’s Criminal Expungement Week for Financial Advisors

- 2017 Termination Disclosure Wiped From Texas Advisor & CCO’s Records

- 10 Questions Wirehouse Advisors Should Ask Themselves Right Now

FINRA just released its annual report. Every year at AdvisorLaw, we have a hard time reconciling the sheer amount of money floating around this self-regulatory organization (SRO) and the relatively paltry results it achieves with that handsome sum. Once you connect the dots, it makes sense that more and more frustrated advisors are fleeing the expensive and draconian servitude of FINRA to run their own RIAs.

Advisors, and the firms they work for, pay massive fees to allow FINRA to oversee securities markets, trading, and financial professionals. Each of those responsibilities purportedly aims to achieve its primary goal of “protecting investors.” Let us thumb through FINRA’s 2022 Budget Summary to see how it’s faring in its mission.

Protecting Investors

This is FINRA’s meat and potatoes. No matter how many holes we poke in FINRA, its keystone justification for its actions has always been its professed purpose of “protecting investors.”

In 2021, as one indication of its gallant efforts, FINRA “protected” the investing public by expelling the rogue firms that were full of bad actors. In fact, it expelled all of… one firm.

Wait. One?

Well, that doesn’t exactly instill confidence. Maybe it would look better if we viewed it as a percentage of all firms overseen by FINRA, which works out to… 0.03%.

Hmm, okay. Maybe not.

But perhaps 2021 was an isolated year, you know, with COVID and all.

2020 saw a total of two firms expelled.

But a year-to-year decrease of 50% isn’t such a fair argument when the sample size is so small. How many firms were expelled in previous years?

| Year | # of Firms Expelled |

|---|---|

| 2021 | 1 firm |

| 2020 | 2 firms |

| 2019 | 6 firms |

| 2018 | 16 firms |

| 2017 | 20 firms |

| 2016 | 24 firms |

Contact us today at (303) 952-4025 for a complimentary consultation!

I think you get the point.

Either FINRA has hunted down and terminated every bad firm in the entire U.S., or perhaps, it’s not as focused as it used to be. Who knows? Maybe it’s been utilizing all of its man-hours working to ensure that financial advisors have no way of removing false allegations against them from BrokerCheck. Surely, even the most resentful investor would consider it an abomination to deny a fellow American due process.

An Issue Of Resources

After so many years defending advisors from FINRA, we could just be too cynical. Perhaps we’re just not taking into account FINRA’s problems. Maybe its inability to find and expel egregious firms is a result of a lack of financial or personnel resources. The theory makes sense. After all, just like local elementary schools, government agencies are notorious for lacking adequate funding.

But at second glance, we see our self-described “not-for-profit organization” is actually doing quite well for itself — a corporation that has been granted governmental immunity, one that’s both infallible and untouchable. Seems reasonable.

Still, could FINRA somehow be hamstrung by a lack of resources?

According to its 2021 Annual Report, FINRA’s revenue has actually continued to rise, year-over-year.

So maybe it is hard to predict just how much revenue is needed, and this is just a gluttonous overcorrection from previous years?

“As we have communicated in more detail in the past, FINRA’s multiyear strategic planning includes targeted fee increases that were detailed in advance and phased in over three years, beginning in 2022…”

— Robert W. Cook, President, and CEO of FINRA.

| Year | Revenue |

|---|---|

| 2017 | $828 Million |

| 2018 | $857 Million |

| 2019 | $899 Million |

| 2020 | $1.105 Billion |

| 2021 | $1.301 Billion |

OK. Maybe not.

If that’s the case, where are all the “member fees” going? Compensating individuals is a good first guess. Let’s see if we can confirm that.

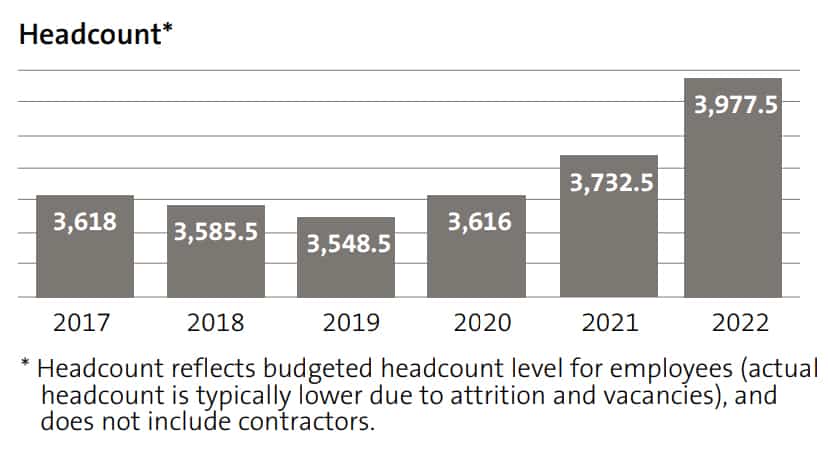

The first graph shows the employee headcount for which FINRA budgeted each year between 2017 and 2022.

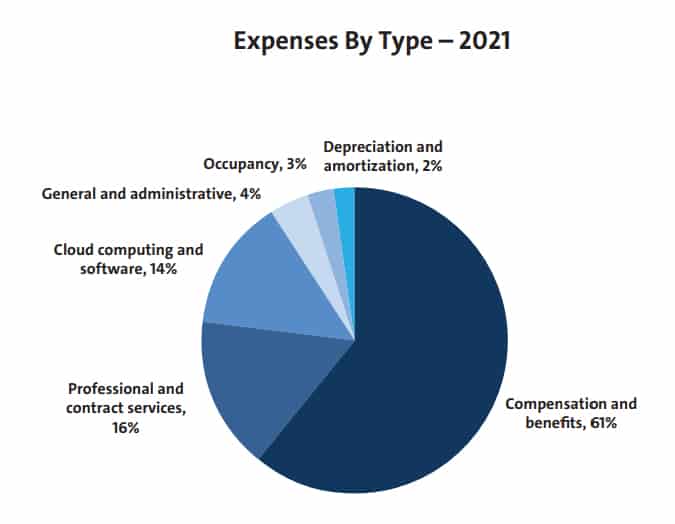

The second shows a pie-chart breakdown of its expenditures in 2021.

Aside from the cost of base technology needed to subsist as a 21st-century corporation (14%), the lion’s share of the rest of the revenue is eaten up by the machine of personnel (both in-house and contractors), working toward FINRA’s effort to expand its size, purview, and control by increasing the number of personnel who are, in turn, seeking to expand their own size, purview, and control. And what do each of those responsibilities demand? Larger salaries!

Remember when it was unclear whether FINRA was a governmental agency? Well, executive compensation is where this corporation sheds ANY similarities to a government agency. To get your bearings on how our government typically pays, SEC Chairs are reported to make around $200,000 per year.

Here are some examples of what FINRA’s executives bring in annually:

| Executive | Total Compensation | Year |

|---|---|---|

| Robert W. Cook, President, and CEO | $3,296,195 | 2021 |

| Todd T. Diganci, EVP, and CFO | $1,507,279 | 2021 |

| Steven J. Randich, EVP, and CIO | $1,608,471 | 2021 |

| Robert L.D. Colby, EVP, and CLO | $1,292,702 | 2021 |

These numbers show what FINRA does with your “member” fees. The word “member” is in quotations because if you read its annual report on revenues, you quickly find out exactly how FINRA views its “members” and the fees it siphons off from them.

“3. REVENUE FROM CONTRACTS WITH CUSTOMERS

We recognize revenue when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration that we expect to receive in exchange for those goods or services. We generate all of our revenue from contracts with customers.”

According to its own report, ALL of FINRA’s revenue is derived from its “customers” — a clear indication of how it sees your relationship.

So, do you feel you are part of a “membership,” or are you merely a “customer”?

Do you receive services from your membership that you feel assist you with building your business and protecting your clients? Or are your fees used to overcompensate the same people who are attempting to limit your right to due process within your own industry?

What Can You Do About It?

AdvisorLaw clients have generally chosen one of two major routes over the years:

Option 1: Our clients who still have a decent runway remaining in their careers often choose to leave FINRA’s jurisdiction and work as an IAR. By either opening their own shop or joining an established RIA, they can move to a place where they actually get to keep the money they make. Sure, the SEC is not without compliance hurdles, as well, but AdvisorLaw’s RIA Division handles everything needed for an advisor to transition out, register, open an RIA, and run the RIA. The cost is a mere sliver of the dollars that firms and FINRA demand for the honor of being “members.”

Option 2: Our clients who have one foot out the door or are considering some type of exit in the next few years often choose to sell their practices. AdvisorLaw’s M&A Division is getting advisors truly staggering multiples on their buyouts through our Practice Purchase Network. For many advisors, realizing the dream of cashing out of their biggest asset, which likely took decades to build, can be an extremely rewarding process — both financially and emotionally.

If you want to kick those tires, check out AdvisorLaw’s practice valuation tool, at no charge. Our tool was developed with a leading accounting firm.

To learn more about becoming an RIA, please fill out the form below for a complimentary consultation.