Navigate the complexities of financial advising with AdvisorLaw's Industry Insights. Our experts provide actionable analysis on critical areas impacting your practice, including the latest FINRA and SEC/state regulations for brokers, RIAs, and IARs, the nuances of dual registration, strategic insights into Mergers & Acquisitions, evolving enforcement trends, practical regulatory compliance strategies, and effective succession planning. Stay informed, compliant, and positioned for growth with AdvisorLaw's perspectives.

WEBINAR: Take Advantage of the SEC Marketing Rule – Legally

If you're an investment advisor looking to stay up-to-date on the latest changes and regulations for marketing, then you won't want to miss this webinar hosted by Myriad Advisor Solutions....

Read More

DOL Employment Rule Threatens Future Of Independent Advisors

The financial advisory industry as we know it may be in jeopardy, due to a proposed Department of Labor (DOL) employment rule pertaining to an employee or independent contractor classification...

Read More

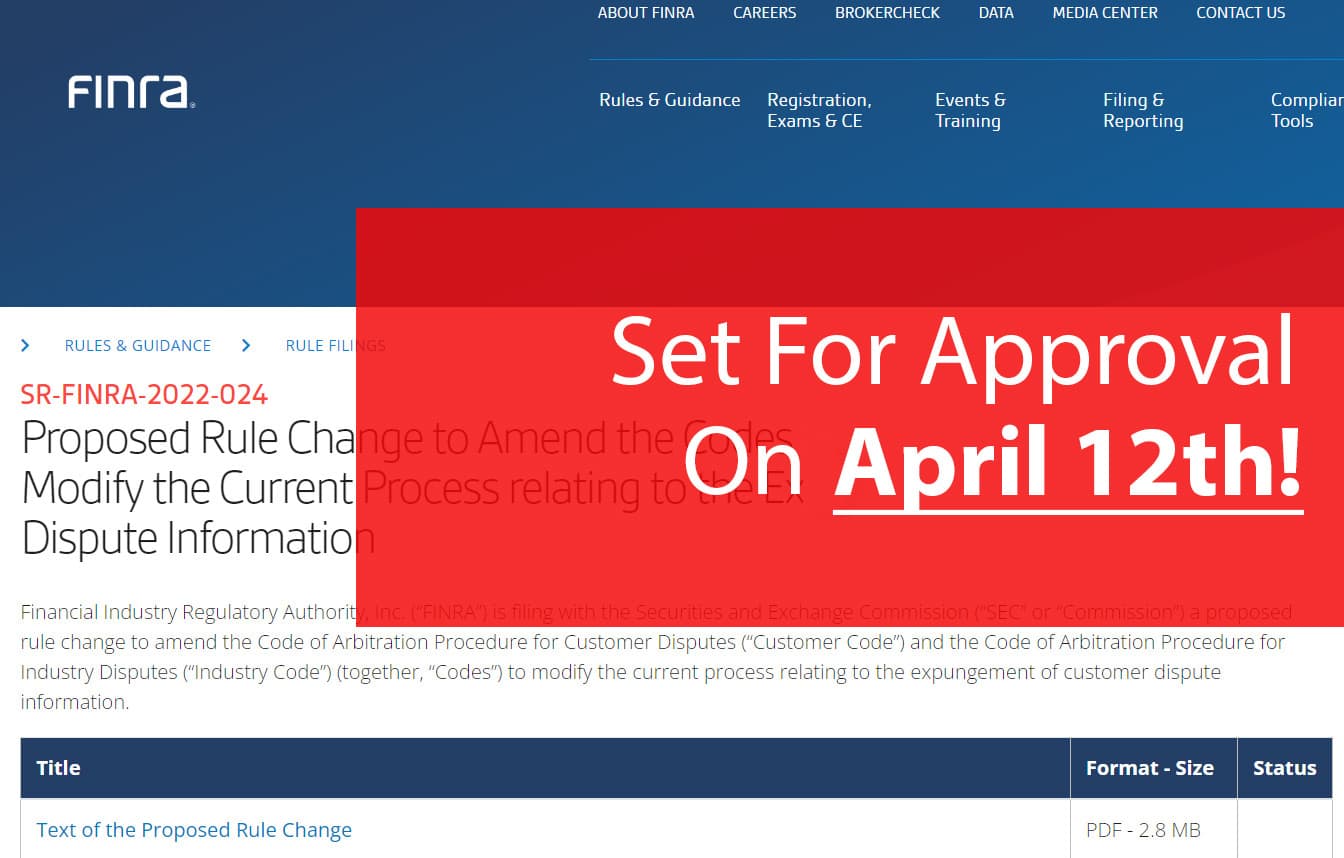

FINRA Disputes & U5 Terminations FINRA Expungement & Arbitration FINRA, SEC, State & CFP Board Enforcement

Financial Advisors Must Act Now To Remove False Disclosures

Contact Us Today! If you are a financial advisor or wealth manager with a public record, you have the right to seek the removal of false or inaccurate disclosures through...

Read More

AdvisorLaw Helps Veteran Advisor Transition to Ideal Firm

AdvisorLaw recently facilitated the successful transition of a veteran financial advisor who had been seeking the expungement of a customer complaint. This advisor had over 20 years of experience and...

Read More

Denver Advisor Clears Records Of Termination Disclosure

A previously-registered broker and current investment advisor in Denver had been in the industry since 2012. She had a perfect BrokerCheck record, aside from a 2017 Form U5 termination disclosure...

Read More

The Importance Of Form ADV Amendments & What RIAs Need To Know

{{dc:post:title}}\n\n{{dc:post:publish_date format='M. d, Y'}}\n\nRead More...\n\n{{dc:author:display_name}}\n\n{{dc:author:bio}}\n\nAs a financial advisor, it’s essential that you understand your obligations when it comes to filing Form ADV with the Securities and Exchange Commission (SEC) or...

Read More

70% Of Financial Advisory Firms Considered An Acquisition This Year

{{dc:post:title}}\n\n{{dc:post:publish_date format='M. d, Y'}}\n\nRead More...\n\n{{dc:author:display_name}}\n\n{{dc:author:bio}}\n\nA strategic acquisition can be a powerful way for a financial advisor to grow their business, but finding the right partner is critical. In the evolving...

Read More

AdvisorLaw Partners with Financial Professionals Coalition

AdvisorLaw is excited to announce its new partnership with the Financial Professionals Coalition, Ltd. The coalition, founded by former FINRA Small Firm Governor, Stephen Kohn, and leading industry lawyer, Bill...

Read More

Boston Advisor Clears 25-Year-Old Criminal Disclosure

An advisor in Boston with nearly three decades in the industry had a criminal disclosure on his records stemming from an incident that occurred back in 1998. The advisor hired...

Read More

SEC Sweep Letters: What You Should Know

In the last few months, the SEC sent out hundreds of sweep letters to registered investment advisor firms requesting information regarding communication devices, policies and procedures, training, oversight, recordkeeping, and...

Read More

Colorado Advisor’s Perfect Record Restored With Expungement

A Colorado advisor approaching 20 years in the financial services industry had one, pesky customer dispute that had stained his records for more than half of his career. He reached...

Read More

Financial Advisor Transition Mergers & Acquisitions Selling RIA Successful Transitions Succession Planning Valuations

AdvisorLaw Secures Triple The Buyout Offer For Financial Advisors

{{dc:post:title}}\n\n{{dc:post:publish_date format='M. d, Y'}}\n\nRead More...\n\n{{dc:author:display_name}}\n\n{{dc:author:bio}}\n\nAdvisorLaw is pleased to announce the successful closure of a significant Mergers & Acquisitions (M&A) transaction, demonstrating our capability to maximize value even on complex internal...

Read More

Termination Reasons Filed On FINRA’s Form U5

The Form U5 is a document used to report the termination of financial advisor (FAs) registrations from a firm or in a particular jurisdiction. Although there are different types of...

Read More

Massachusetts Advisor Wins Expungement Of Five Disputes

A 45-plus-year veteran of the financial services industry had five customer disputes that had accumulated on his public BrokerCheck and CRD records between 2013 and 2018. The customers had sought...

Read More

Louisiana Advisor Clears Records With Triple Disclosure Expungement

An advisor out of Louisiana approaching a quarter of a century in the industry had three customer disputes on his records. Two of the disputes had been lodged around 2010,...

Read More

FINRA Disputes & U5 Terminations FINRA Expungement & Arbitration FINRA, SEC, State & CFP Board Enforcement

The SEC’s Recent Ruling For High-Risk Firms

The Securities and Exchange Commission (SEC) recently approved FINRA's new rule that allows it to display an alert on its BrokerCheck tool when a brokerage firm is flagged as "restricted."...

Read More

2022 Was a Big Year for SEC Enforcement

On November 15, 2022, the U.S. Securities and Exchange Commission (SEC) announced the results of its latest round of enforcement actions against investment advisors. Compared to FY 2021: Enforcement actions increased...

Read More

Investment Advisor Wins Expungement Of 1997 U5 Termination

In the late 1990s, about ten years into his career as a financial services professional, this advisor was terminated from the firm he had joined not two years prior. After...

Read More

Understanding The Impact Of New AIMR Analytics Site — AdvisorCheck.com

Last week, AIMR Analytics launched a new website, AdvisorCheck.com, which pulls together data from both BrokerCheck and the Form ADV so that prospective investors and hiring firms can easily weed...

Read More

Completing Your Annual Compliance Review: Dos And Don’ts For RIAs

As March quickly approaches, RIAs are reminded that it’s time to review their annual compliance. Every year, it’s vital for firms to hold an annual meeting with employees to thoroughly...

Read More