- Regulatory Shift? The Supreme Court Challenges SEC’s Authority

- FINRA Arbitrator Grants Expungement Of 2011 Customer Dispute For Illinois Advisor

- E-Signatures: From Convenience To Compliance Minefield

- Tucson Advisor Granted Expungement Of Disputes — One Dating Back To 1994

- CFP Board To Publicly Disclose Disciplinary Records: Are You Prepared?

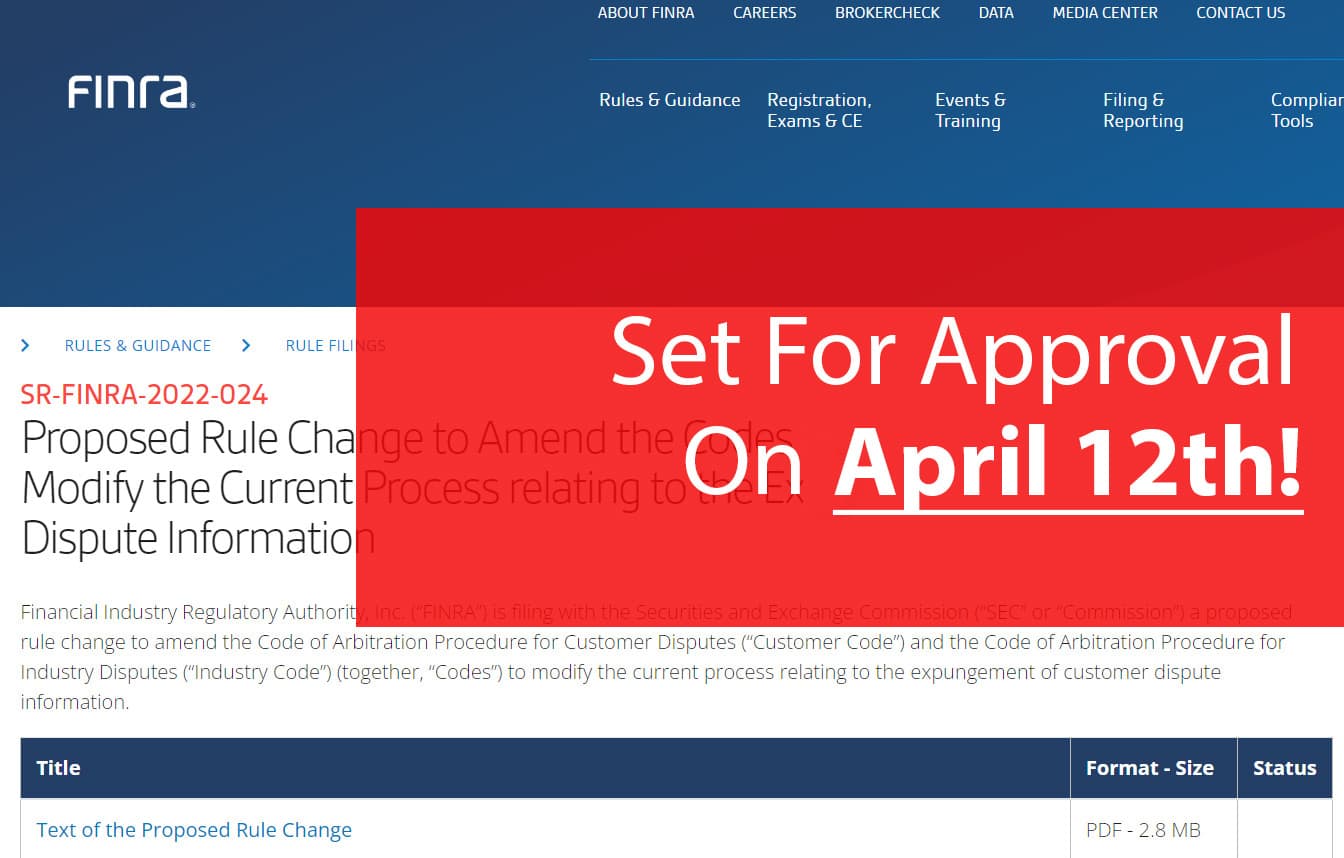

If you are a financial advisor or wealth manager with a public record, you have the right to seek the removal of false or inaccurate disclosures through the Financial Industry Regulatory Authority’s (FINRA) Dispute Resolution forum. The disputed information can include allegations of misconduct, customer complaints, arbitration claims, and more. However, this right may soon become much more difficult to exercise, should FINRA’s new expungement rule proposal be approved by the Securities Exchange Commission (SEC).

On April 12th, the SEC will likely approve FINRA’s latest proposal, introducing new, stringent guidelines that will make it incredibly difficult for advisors to seek the removal of false or inaccurate disclosures from their records, including the CRD, BrokerCheck, and IAPD/IARD.

What’s in the SR-FINRA-2022-024 expungement proposal?

This proposal aims to make it more difficult for advisors to seek expungement of disclosures by introducing several new requirements. Here are five of the most alarming:

- A three-arbitrator panel (rather than a sole arbitrator) will be required for expungement. This is intended to increase the level of scrutiny applied to expungement requests.

- A unanimous decision by the panel will be required in order for expungement to be granted. This is a significant change from the current rule, which requires only a majority decision. The higher threshold for approval is intended to ensure that expungement is only granted in cases where it is truly warranted.

- Stricter eligibility requirements will be imposed. Specifically, financial advisors will only be eligible for expungement if they have obtained a favorable arbitration award or settlement on the underlying claim, and the panel finds that the disclosure at issue is clearly erroneous or misleading. This requirement purports to ensure that only legitimate requests for expungement are granted.

- Time limits will be placed on requesting expungements. Financial advisors will only be able to request expungement within one year of the date of the underlying event or within two years of the date of filing the arbitration claim — whichever is earlier. This requirement is intended to prevent financial advisors from waiting “too long” to seek expungement, and it could result in stale or outdated information remaining on their public records.

- State regulators will have the right to object to requests for expungement. This is intended to ensure that state regulators have a say in the expungement process and can help prevent the removal of legitimate disclosures from financial advisors’ public records.

Outside Investor Attorneys Force FINRA’s Hand

For years, the Public Investors Advocate Bar Association (PIABA) and other investor groups have been putting immense pressure on FINRA and the SEC to restrict access to expungement, and their efforts seem to have paid off. These proposed changes to the expungement process seem to be a direct response to concerns raised by plaintiff lawyers and groups like PIABA, who claim that advisors have been abusing the process for years, in order to cover up various occurrences of misconduct. These customer-protection groups believe that allowing financial advisors to seek the removal of disclosures from their public records undermines the integrity of the regulatory system and poses a risk to investors. However, there is no data to support such claims, and we believe that it’s unfair to deny advisors the right to a fair trial based on unfounded allegations.

It is important to strike a balance between protecting investors and ensuring that advisors are not unfairly targeted. By making it excessively difficult for advisors to seek the removal of false or inaccurate disclosures from their public records, PIABA, and other groups are essentially denying advisors their rights and putting their livelihoods at risk. While it is important to protect investors, it’s equally important to protect advisors.

Financial Advisors Oppose The New Rule

FINRA’s latest proposal has been met with criticism from financial advisors and broker-dealers alike. Many financial advisors and wealth managers argue that the proposed changes will unfairly penalize those who have been falsely accused of misconduct by making it harder and more costly for advisors to have unfounded or unjust complaints removed from their public records. They claim that the current system already provides sufficient safeguards to prevent the abuse of the expungement process and that the proposed changes are unnecessary and overly burdensome.

Once this proposal is approved, financial advisors who have been victims of false or inaccurate disclosures will have to navigate a more complex, expensive, and time-consuming process to seek expungement. They may also face increased scrutiny from state regulators, who will now have the right to object to requests for expungement.

Financial advisors point out that there is little evidence to suggest that the expungement process is being abused or misused. In fact, according to a recent study by FINRA, only a small percentage of expungement requests are granted — suggesting that the current system is already working as intended.

Do you have disclosures on your record?

The looming approval of FINRA’s expungement proposal and the implementation of Rule 4111 this year put enormous pressure on financial advisors to have clean records. Fortunately, there are steps you can take to protect your record. AdvisorLaw’s team of experienced attorneys specializes in successfully removing disclosures from the public record, and we have expunged more than 2,246 disclosures from advisors’ BrokerCheck, CRD, and IAPD/IARD records over the last decade. Our successful expungements include:

- customer disputes: complaints or disputes made against the advisor that was settled, denied, withdrawn, or closed with no action;

- financial issues: disclosures related to financial issues, such as bankruptcy or tax liens, that were resolved or paid off;

- termination disclosures: inaccurate or defamatory Form-U5 disclosures; and

- regulatory actions: civil judgments or orders by state securities regulators that were vacated or overturned, for example.

Don’t wait until it’s too late to protect your livelihood. If you’re interested in removing the disclosures on your record, be sure to file your case before this new rule takes effect. Otherwise, you will lose your ability to be grandfathered in under the current, more lenient, rule structure. Let AdvisorLaw guide you through the expungement process and defend your reputation.