Is your CRM vendor an SEC compliance liability? Understanding Third-Party Risk

FINRA Arbitrators Expunge Unsuitability Complaints From Florida Financial Planner’s Record

AdvisorLaw Wins $295K For Ameriprise Advisor In Succession Contract Battle

FINRA Panel Grants Expungement Of Trade Delay Allegation For Virginia Advisor

AdvisorLaw Wins Unanimous FINRA Expungement for False Liquidity Allegations

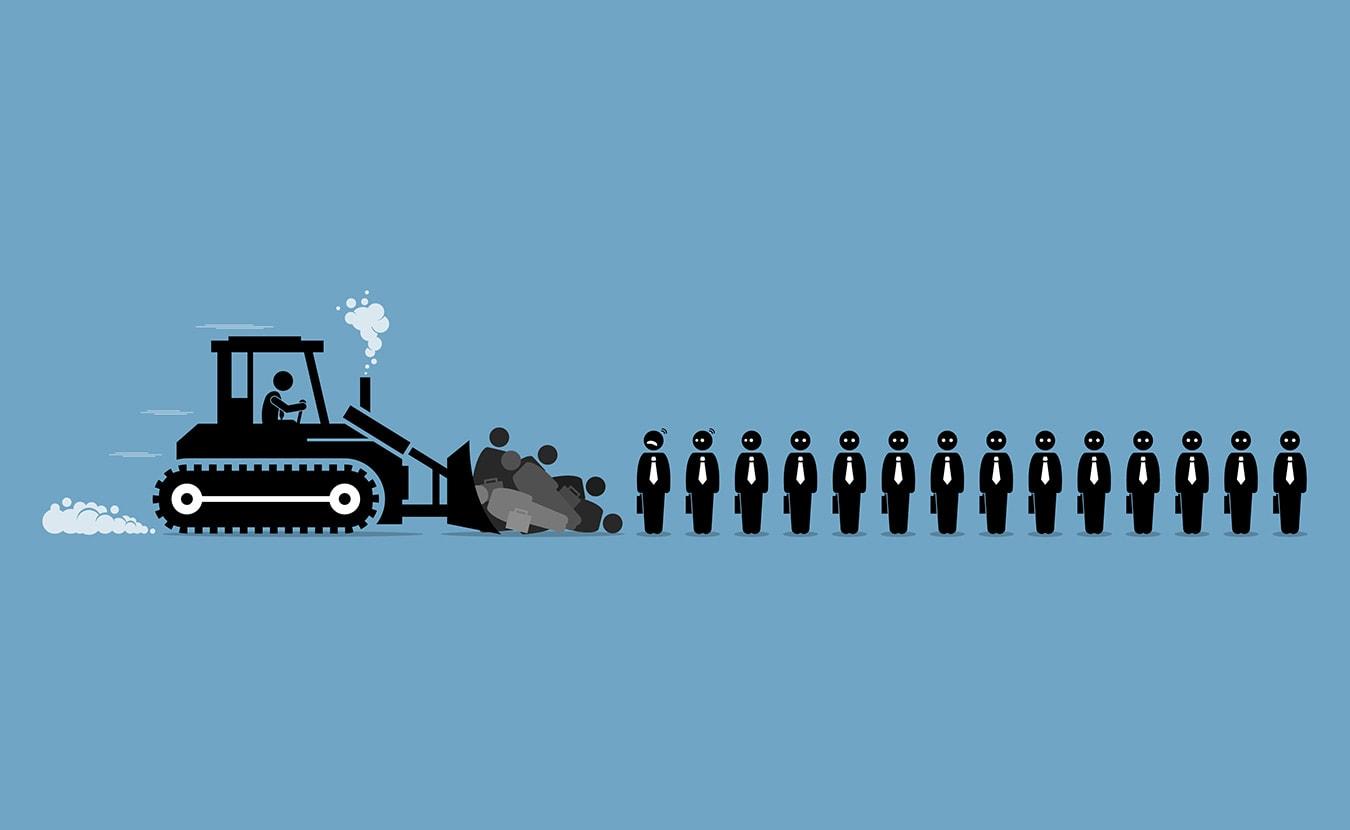

We are witnessing a significant surge in the termination of high-profile and multi-billion-dollar advisors. If you are a financial professional, these industry-wide firings should serve as a stark warning. Maintaining a high ranking on Barron’s, holding executive status, or managing substantial assets under management (AUM) no longer guarantees immunity from firm-level or regulatory scrutiny.

Recently, the frequency of advisors terminated for reasons other than "voluntary" has risen dramatically. While some separations are valid, AdvisorLaw has identified a troubling trend: a spike in Form U5 termination cases featuring retaliatory allegations or discharges arising from increasingly aggressive zero-tolerance compliance policies.

Strategic Mitigation of Form U5 Disclosures

It is critical that advisors understand how to navigate the 30-day window following a termination. From negotiating Form U5 narrative language to securing a "clean" transition, every step determines your future employability.

1. The New Compliance Reality: Shortcuts are Career-Enders

In the 2026 regulatory environment, what was formerly "standard practice" is now a fireable offense. Firms are utilizing AI-driven monitoring to enforce policies with zero margin for error. Terminations are now common for:

- Off-Channel Communications: Using unapproved messaging apps (text, WhatsApp) for client business.

- "Pre-signed" Documents: Any administrative shortcut regarding client signatures.

- Expense & "AI-Washing": Minor expense report discrepancies or misleading claims about the use of AI in investment processes.

- Takeaway: Strict adherence to firm policy is the only way to avoid a "Discharged" mark.

2. Identifying "Un-Hirable" Disclosure Events

A terminated advisor with the following marks on their CRD or BrokerCheck will face extreme difficulty in 2026 recruitment:

- Alleged violations of sales practices or breach of fiduciary duty.

- Pending client complaints or ongoing FINRA/SEC investigations.

- Defamatory U5 Language: Narrative descriptions that imply unethical conduct.

- Negative financial disclosures, such as unsatisfied tax liens or bankruptcies.

3. Tidy Up Your Public Record

Advisors must proactively review their CRD, IAPD, and BrokerCheck records. Under FINRA Rule 2080, meritless or false disclosures can be removed through the arbitration process.

AdvisorLaw Fact: Our team has expunged over 2,800 disclosures, including tax liens, investor complaints, and retaliatory U5 marks. View our recent expungement awards here.

4. The Impact of FINRA Rule 4111 (Restricted Firm Obligations)

When seeking a new firm, "casting a wide net" is more complex due to FINRA Rule 4111. This rule allows FINRA to designate firms as "Restricted" if they hire too many advisors with disclosure histories.

- Hiring Hurdles: Firms are now less likely to hire a terminated advisor if they are nearing their "high-risk" threshold.

- Mass Layoffs: Rule 4111 essentially incentivizes firms to terminate advisors with disclosures to avoid high-capital deposit requirements.

5. Transitioning to Independence (RIA Status)

If you are tired of a shifting regulatory landscape and "weaponized" compliance, 2026 is the year to consider the Registered Investment Advisor (RIA) model. Becoming an independent RIA puts you in control of your brand and compliance culture. AdvisorLaw offers comprehensive RIA setup, registration, and ongoing compliance services tailored to 2026 SEC and state standards.

6. Transparency and Transition Deals

- Be Forward: If you have been terminated, full transparency is required. Firms use AI to benchmark your history against peers; any discrepancy is a red flag.

- Manage Financial Expectations: Do not expect a high-tier transition package if your U5 reads "Discharged." Your priority must be securing a landing spot to preserve your client base and AUM.

Were You Recently Terminated or Blindsided?

f you believe a termination is imminent, or if you need to remove a defamatory disclosure from your record, AdvisorLaw’s expert counsel can help you navigate this delicate process. Call us today at (303) 952-4025.

Contact us for a free consultation and learn how AdvisorLaw can help safeguard your practice.

Engage with our experts today!