Navigate the complexities of financial advising with AdvisorLaw's Industry Insights. Our experts provide actionable analysis on critical areas impacting your practice, including the latest FINRA and SEC/state regulations for brokers, RIAs, and IARs, the nuances of dual registration, strategic insights into Mergers & Acquisitions, evolving enforcement trends, practical regulatory compliance strategies, and effective succession planning. Stay informed, compliant, and positioned for growth with AdvisorLaw's perspectives.

CFP Board vs. BrokerCheck: A Battle for Advisor Fairness

{{dc:post:title}}\n\n{{dc:post:publish_date format='M. d, Y'}}\n\nRead More...\n\n{{dc:author:display_name}}\n\n{{dc:author:bio}}\n\nIn an unexpected move, the CFP Board—a leading authority on ethical and professional standards in financial planning—has raised serious concerns about the accuracy of FINRA’s BrokerCheck...

Read MoreOutsourced CCO for RIAs: Is It SEC-Compliant?

Are RIAs allowed to outsource their CCO? Get clarity on SEC rules, proposed regulations, and the importance of an empowered, independent chief compliance officer.

Read MoreYour 2025 RIA Compliance Checklist: Insights from a Leading Expert

Get insights on SEC priorities for 2025 from AdvisorLaw's expert, Michelle Atlas-Quinn. Learn how to navigate compliance, fees, and client communication risks. Earn CE credit.

Read MoreFinancial Advisor Disclosures: How a “Marked” Record Can Tank Your Career Mobility

Don't let a blemished record hold you back. Learn how your BrokerCheck disclosures are limiting your career as a financial advisor and what you can do about it.

Read MoreFinancial Advisor M&A Consulting: Maximizing Your Practice Value with AdvisorLaw

For independent financial advisors, the decision to sell, merge, or acquire a practice is one of the most pivotal in a career. Yet too many advisors enter the M&A process...

Read MoreTexas Advisor Clears Records With Two Successful Customer Dispute Expungements

A seasoned Texas financial advisor with over two decades in the industry sought to clear the only disclosures on his otherwise-perfect Central Registration Depository (CRD) and BrokerCheck® records.

Read MoreHow to Start an RIA: The Ultimate Guide for Financial Advisors

Navigate the complexities of RIA registration with confidence. Our guide covers everything from SEC and state requirements to business formation, helping you launch your registered investment advisor firm with ease.

Read MoreAdvisorLaw: 10 Years Empowering Advisors

As we celebrate ten years of relentless advocacy and innovation, AdvisorLaw continues to set the standard in the financial services industry. From day one, our mission has been clear: to...

Read MorePart 3: Safeguarding Your RIA & Understanding SEC Consequences

{{dc:post:title}}\n\n{{dc:post:publish_date format='M. d, Y'}}\n\nContact Us\n\n{{dc:author:display_name}}\n\n{{dc:author:bio}}\n\nIn Parts 1 and 2, we explored the complexities of RIA supervision, the necessity of tailored compliance programs, and the critical role of regular reviews in...

Read MoreVirginia Advisor Clears Records With Customer Dispute Expungements

In October 2024, a Virginia Beach-based advisor of ten years sought to rectify his professional record by pursuing expungement of two customer dispute disclosures listed on his Central Registration Depository...

Read MoreTexas Advisor Clears Records With Successful Expungements In FINRA Arbitration

Over nearly 25 years in the industry, this Texas-based financial advisor (FA) acquired two customer disputes on his Central Registration Depository (CRD) and public BrokerCheck® records.

Read MoreCalifornia Adviser Restores Clean Record With U5 Termination Disclosure Expungement

In July 2021, a San Francisco-based investment advisor and former broker faced a negative termination disclosure on his Central Registration Depository (CRD) and public BrokerCheck® records.

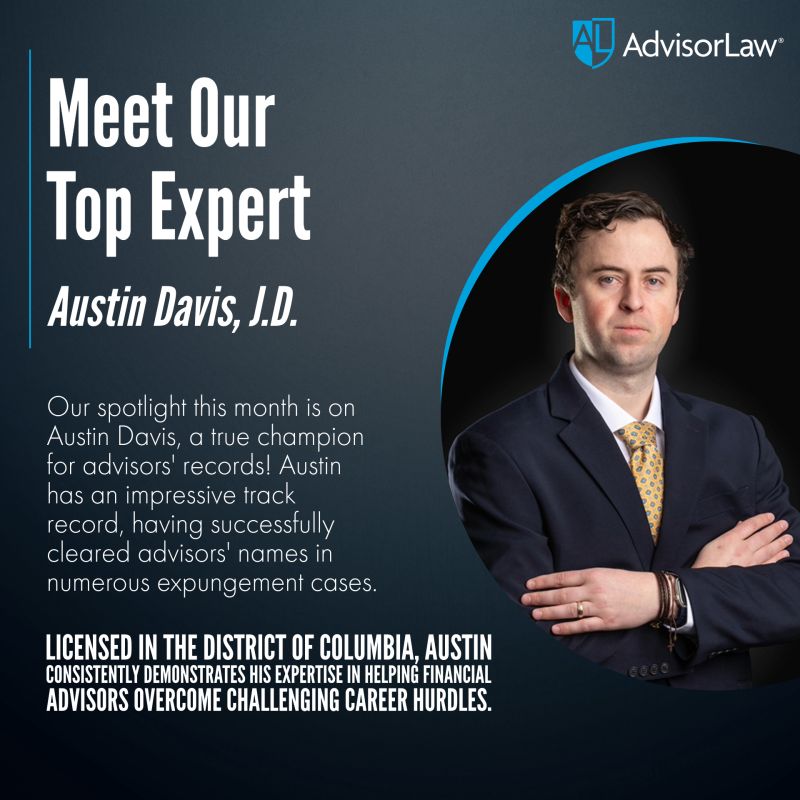

Read MoreAdvisorLaw Spotlight: Austin Davis, J.D.

Meet Austin Davis, Esq. — an invaluable associate attorney at AdvisorLaw. Austin has an impressive track record, having successfully cleared advisors' names in numerous expungement cases.

Read MorePart 2: Strategies For Risk Mitigation & The Importance of Ongoing Reviews

In Part 1, we examined the complexities of SEC supervisory requirements and the risks faced by small RIAs. This second installment shifts to covering actionable strategies for crafting tailored compliance...

Read MorePart 1: The Complexities Of RIA Supervision

Navigating RIA supervision? Discover the complex challenges small firms face, SEC requirements, and the risks of inadequate compliance in Part 1 of our series. Learn why robust oversight is crucial...

Read MoreMisleading Termination Expunged From Pennsylvania Advisor’s Record

Financial advisor's misleading Edward Jones termination expunged from FINRA CRD & BrokerCheck. Learn how to clear false U5 disclosures & restore your career.

Read MoreNow Offering: Private Fund Formation & Ongoing Compliance Services

AdvisorLaw is excited to announce a comprehensive new service line tailored specifically for financial professionals looking to launch and manage private funds.

Read MoreNorth Carolina Advisor Restores Perfect Public Records Through FINRA Expungement

In June 2024, a North Carolina-based financial advisor (FA) faced a customer dispute disclosure on his Central Registration Depository (CRD) and public BrokerCheck® records.

Read MoreFINRA Grants Expungement Of Advisor’s Misleading Termination

A Connecticut financial advisor successfully secured expungement of a false 2024 termination disclosure related to "underperformance" from his FINRA CRD and BrokerCheck records. FINRA's decision against Resolute Investment Distributors highlights...

Read MoreUnlock RIA Growth: How Compliance Automation Drives Efficiency

In the complex world of RIAs, true compliance is essential for building trust and running a successful business. However, relying on manual compliance methods can drain resources and slow you...

Read More