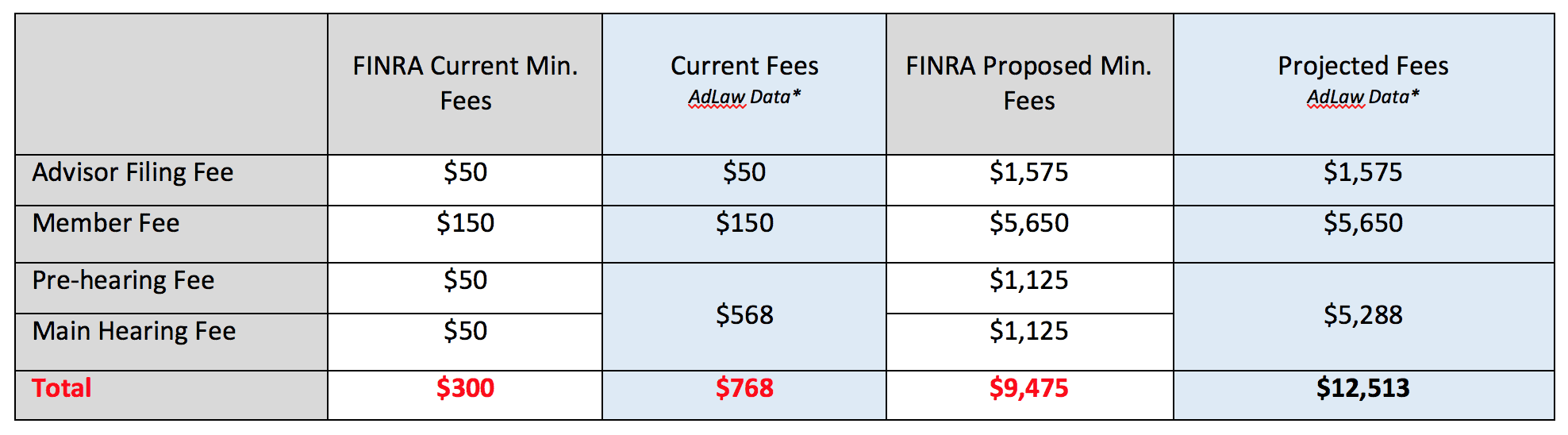

Proposed rule changes in front of the SEC exponentially increase the minimum fees for FINRA disclosure expungement from $50 to $1,575. So, a typical expungement case would ultimately jump from $768 to well over $10,000.

As we previously warned, on February 7, 2020, FINRA issued a Rule Filing Status Report (SR-FINRA-2020-005). The 219-page status report provides some insight into the regulator’s advancement of several changes to the customer dispute and the U5 termination expungement process through the FINRA Dispute Resolution arbitration forum.

Timeline Of FINRA Expungement Forum Modifications

December 2017 – Proposed Amendment

FINRA initially proposed extensive changes to the customer dispute expungement process. (Regulatory Notice 17-42)

December 2018 – Approved Amendment

“The [FINRA] Board [of Governors] approved proposed amendments to the Codes of Arbitration Procedure for Customer and Industry Disputes to codify the Notice to Arbitrators and Parties on Expanded Expungement Guidance and modify the fees for small claim expungement.”

March 2019 – Congressional Pressure

Senator Elizabeth Warren (D–MA) published an open letter to FINRA President and CEO, Robert W. Cook, pressuring Cook to submit the proposed Rule changes to the SEC for approval.

September 2019 – SEC Filing For Arbitrator Panel Changes

FINRA Board of Governors meeting minutes contained language indicating that “[t]he Board approved proposed amendments to the Code of Arbitration Procedure to create, among other things, a roster of arbitrators with enhanced training and experience from which a panel would be selected in certain instances to decide an associated person’s request to expunge customer dispute information. The proposed amendments will next be filed with the SEC.” (September 2019 Meeting Minutes)

October 2019 – PIABA Expungement “Study”

The PIABA Foundation published an “Expungement Study” purporting to be a neutral perspective on the customer dispute expungement process through FINRA’s Dispute Resolution arbitration forum. PIABA pressured FINRA that, “This is a situation that requires major surgery…”

Proposed Fee Changes That FINRA Is Adopting

Increased Minimum Filing Fees

SR 2020-005 increases the minimum filing fee against an advisor from $50 to at $1,575 — more than a 3,000% increase.

Increased Hearing Session Fees

SR 2020-005 increases each hearing session fee under the proposed changes move from $50 to $1,125 — more than a 2,100% increase.

Rules 12401 and 13401, which are applicable to all arbitrations within FINRA’s Dispute Resolution arbitration forum, dictate that the amount of monetary relief at issue determines whether the matter will be heard by a sole arbitrator or a three-person panel of arbitrators. Regardless of the amount of monetary relief requested, the Rules authorize “the parties to agree in writing to one arbitrator.”

In a vast departure from these Rules, SR 2020-005 proposes that Rules 12401 and 13401 shall not apply to arbitrations in which expungement relief is requested. More pointedly, SR 2020-005 proposes that the right of “the parties [to] agree in writing to one arbitrator” be denied to those seeking expungement relief.

The result of this disparate treatment of parties to expungement claims conveniently increases each hearing session fee when compared to a sole arbitrator hearing a non-monetary claim.

Additional Hearing Session Fees

FINRA also makes the assumption that one initial prehearing conference and one hearing on the merits will be sufficient to account for all hearing sessions. However, in the 721 expungement cases completed by AdvisorLaw, the average number of hearing sessions for each case was 4.7. Under the proposed Rule change, the average total hearing session fee would be $5,287 — a far cry from the $2,250 that FINRA estimates.

The Final Tally

- Advisors seeking expungement would be assessed a minimum of an additional $3,675 from the current rates

- Member firms would be assessed a minimum of an additional $5,550 from the current rates

- Total fees paid to FINRA from the collective parties would be a minimum of an additional $9,175 from the current rates

What used to average around $768 in total fees to FINRA to seek expungement of a meritless disclosure will now be close to $10,000!

Proposed Arbitration Panel Changes That FINRA Is Adopting

In a footnote on page three, FINRA mentions that “FINRA is separately developing changes to the current expungement framework, including codifying as rules the Notice to Arbitrators and Parties on Expanded Expungement Guidance.”

This promise (threat) by FINRA is eerily familiar to us. In December of 2017, via Reg. Notice 17-42, FINRA asserted that “FINRA Board of Governors has approved filing with the [SEC] to make the best practices from the Notice to Arbitrators and Parties [ ] rules that the arbitrators must follow when considering expungement requests.”

In essence, for over two years, FINRA has been telling the public that its Board approved the codification of the five-page document and merely needed to be submitted to the SEC for approval.

Even in this latest mention, FINRA remains silent on the issue of why it has not been submitted to the SEC for approval at any point in the preceding 25-plus months.

Proposed Changes That FINRA Does Not Address

A number of the broad and sweeping changes proposed by FINRA in the December 2017 Reg. Notice 17-42 have seemingly gone by the wayside, including:

- doing away with telephonic hearings;

- formally prohibiting the ability of advisors to name the underlying investor(s), who instigated the false, erroneous, or baseless complaint;

- prohibiting advisors from seeking expungement of claims more than one year old; and

- requiring a unanimous decision (3/3) in favor of expungement, rather than a majority (2/3) in favor, as is the requirement for all other arbitrations within the forum.

The Walls Are Getting Taller, And The Costs Exponentially Higher

FINRA’s attempt to portray SR 2020-005 as a thorough analysis, discussion, and explanation of the proposed changes left us wanting.

The document lacks any meaningful explanation as to the justification for increasing the costs and obstacles for those seeking to obtain expungement relief. References to lost income through expungement become hollow when considering the sheer magnitude of meritless disclosures levied against its patrons. Further, FINRA’s cries of missed opportunities for revenue become tired when you review its nearly billion-dollar annual budget for mere administration.

Actions by FINRA and investor advocates to increase the costs and difficulty of seeking expungement relief amount to nothing more than a brazen and outward expression of its unwillingness to allow the accused the right to a determination as to their guilt or innocence.

FINRA continues to expend tremendous resources, aimed at erecting additional barriers and outrageously inflating costs associated with seeking expungement. Its efforts to dissuade those seeking the opportunity for a neutral third-party arbitrator to determine the merit, or lack thereof, associated with an investor’s complaint are entirely off point.

- Why not implement measures to ensure that investors’ complaints are vetted?

- Why not only publicly disclose those investor complaints that have been adjudicated and found to have a factual basis?

- Why are settlements that are entered into unilaterally by broker-dealers publicly reported on the on the advisor’s BrokerCheck profile, while the very same settlements are omitted from the broker-dealers’ BrokerCheck profiles?

Financial advisors are simply seeking the due process afforded to all Americans to clear their good name. For those burdened with the stigma and harm caused by meritless customer complaints or U5 termination disclosures, these new changes will prove to be a tremendous financial barrier at affording them access to the expungement process.

AdvisorLaw

Contact us by phone: (303) 952-4025 for a free consultation as to the viability of your case. We win nearly 90% of our cases, and we can give you an honest assessment as to what it would take to remove disclosures from your BrokerCheck.